The Ultimate Guide To Feie Calculator

Table of ContentsSee This Report on Feie CalculatorFeie Calculator Things To Know Before You BuyRumored Buzz on Feie CalculatorThings about Feie CalculatorAbout Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.Not known Details About Feie Calculator

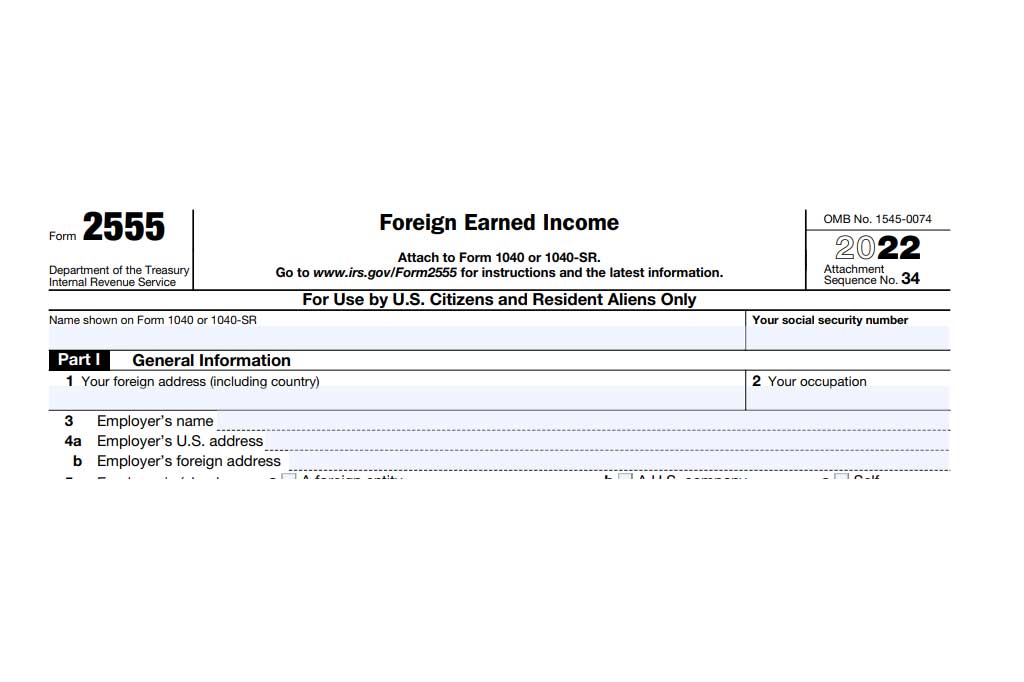

If he 'd frequently traveled, he would instead complete Part III, providing the 12-month period he satisfied the Physical Existence Test and his travel history - Form 2555. Action 3: Coverage Foreign Income (Component IV): Mark made 4,500 each month (54,000 every year). He enters this under "Foreign Earned Income." If his employer-provided real estate, its value is additionally consisted of.Mark determines the currency exchange rate (e.g., 1 EUR = 1.10 USD) and transforms his income (54,000 1.10 = $59,400). Considering that he resided in Germany all year, the percent of time he stayed abroad during the tax obligation is 100% and he gets in $59,400 as his FEIE. Ultimately, Mark reports overall earnings on his Form 1040 and gets in the FEIE as an unfavorable amount on time 1, Line 8d, reducing his taxed revenue.

Selecting the FEIE when it's not the finest alternative: The FEIE might not be ideal if you have a high unearned income, gain even more than the exemption restriction, or live in a high-tax country where the Foreign Tax Credit Score (FTC) may be extra useful. The Foreign Tax Credit (FTC) is a tax reduction approach often made use of along with the FEIE.

Fascination About Feie Calculator

deportees to offset their united state tax debt with international income tax obligations paid on a dollar-for-dollar reduction basis. This suggests that in high-tax countries, the FTC can usually get rid of U.S. tax financial debt totally. Nevertheless, the FTC has restrictions on qualified taxes and the maximum case amount: Eligible taxes: Only income tax obligations (or taxes instead of income tax obligations) paid to foreign governments are qualified.

tax obligation responsibility on your international income. If the foreign tax obligations you paid surpass this limitation, the excess international tax can usually be continued for up to 10 years or brought back one year (using a modified return). Keeping exact documents of international revenue and taxes paid is therefore crucial to computing the right FTC and preserving tax conformity.

expatriates to minimize their tax obligation liabilities. For example, if a united state taxpayer has $250,000 in foreign-earned revenue, they can leave out approximately $130,000 utilizing the FEIE (2025 ). The continuing to be $120,000 may then undergo taxes, but the U.S. taxpayer can possibly use the Foreign Tax obligation Credit report to balance out the taxes paid to the international nation.

The Ultimate Guide To Feie Calculator

He sold his United state home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his spouse to assist satisfy the Bona Fide Residency Examination. Additionally, Neil safeguarded a long-lasting building lease in Mexico, with plans to at some point purchase a residential property. "I presently have a six-month lease on a house in Mexico that I can extend one more 6 months, with the intention to get a home down there." Nonetheless, Neil directs out that read what he said purchasing building abroad can be challenging without very first experiencing the area.

"It's something that individuals need to be truly persistent regarding," he claims, and recommends deportees to be careful of common blunders, such as overstaying in the United state

Neil is careful to stress to Anxiety tax authorities that "I'm not conducting any carrying out any type of Organization. The United state is one of the couple of nations that tax obligations its citizens regardless of where they live, implying that also if a deportee has no income from U.S.

9 Simple Techniques For Feie Calculator

tax return. "The Foreign Tax Debt permits individuals functioning in high-tax nations like the UK to offset their United state tax obligation obligation by the amount they have actually currently paid in tax obligations abroad," claims Lewis.

The prospect of reduced living prices can be appealing, however it usually features trade-offs that aren't promptly obvious - https://www.goodreads.com/user/show/192466965-feie-calculator. Real estate, as an example, can be more economical in some nations, yet this can indicate compromising on facilities, security, or accessibility to trusted utilities and services. Cost-effective residential or commercial properties could be found in areas with inconsistent net, restricted mass transit, or unstable health care facilitiesfactors that can considerably impact your daily life

Below are some of one of the most often asked questions regarding the FEIE and other exclusions The International Earned Revenue Exemption (FEIE) allows united state taxpayers to exclude up to $130,000 of foreign-earned earnings from government income tax obligation, minimizing their united state tax obligation. To receive FEIE, you need to fulfill either the Physical Existence Examination (330 days abroad) or the Authentic Residence Test (prove your main residence in an international country for a whole tax obligation year).

The Physical Visibility Test needs you to be outside the united state for 330 days within a 12-month period. The Physical Visibility Test likewise calls for united state taxpayers to have both a foreign revenue and an international tax home. A tax home is specified as your prime area for business or employment, regardless of your family members's residence. https://www.pubpub.org/user/feie-calculator.

8 Easy Facts About Feie Calculator Explained

An earnings tax obligation treaty in between the united state and an additional country can assist protect against dual taxes. While the Foreign Earned Revenue Exclusion lowers gross income, a treaty may give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Checking Account Record) is a called for declare united state residents with over $10,000 in foreign financial accounts.

The international made income exemptions, occasionally described as the Sec. 911 exclusions, leave out tax obligation on salaries earned from functioning abroad. The exclusions consist of 2 parts - an income exemption and a real estate exclusion. The adhering to FAQs discuss the advantage of the exclusions including when both partners are expats in a general way.

The 2-Minute Rule for Feie Calculator

The tax obligation advantage leaves out the revenue from tax at bottom tax prices. Previously, the exemptions "came off the top" reducing income subject to tax obligation at the leading tax rates.

These exemptions do not spare the wages from US taxes yet merely supply a tax obligation reduction. Keep in mind that a bachelor working abroad for all of 2025 who made concerning $145,000 without various other earnings will certainly have gross income decreased to absolutely no - successfully the exact same answer as being "tax obligation totally free." The exemptions are computed daily.

If you attended business conferences or seminars in the US while living abroad, income for those days can not be left out. For US tax it does not matter where you maintain your funds - you are taxed on your around the world revenue as an US person.

Comments on “How Feie Calculator can Save You Time, Stress, and Money.”